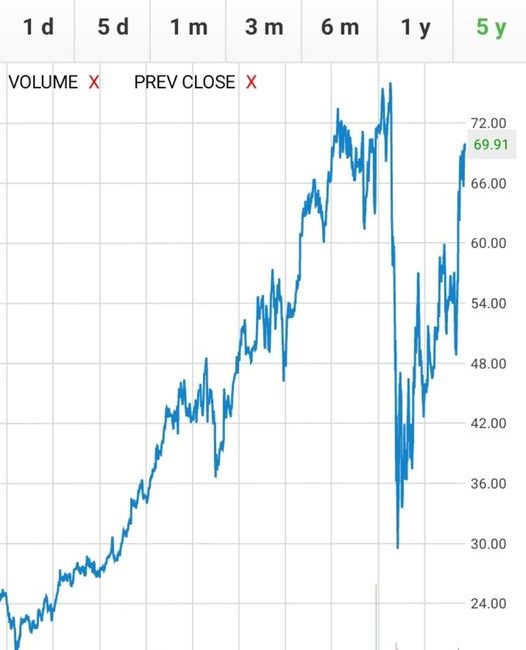

David Stasney in Colorado Original Band Community (on Facebook): LiveNation Stock is almost as high as it was right before the C19 crash now, which was an all time high. Thoughts?

David: Saudi Arabia (The country) invested $500mm of their own $ back in late Spring / early Summer. That gave them a 5% ownership stake.

Michael St. James: 1. The new insurance riders are going to completely insulate them, put pressure on managers and venues for the downside of tix 2. It is widely expected that LN will buy up many of the “about to go bankrupt” venues because they have the capital and know the valuations. (And now, the hedge funds are providing then with the ammo (money and market cap) to do so.

David —-> Michael: Best guess as to…. will the artists be even more on the hook to “Pull the train?”

Michael —-> David: In short, yes. The newer promoter / management side deals will put more onus on the artist side to sell through and more risk should crowds not return or there is another unforeseen event. Less guarantees, lots more carve outs in the contracts

Stu Cruden: Don’t know much about it’s financials but the chart (LYV) looks like it’s consolidating around the 10-day average after a big 1-day move about a month ago. It’s near it’s 52-week high but well above 50 and 100-day support lines. Lots of charts like this look over-bought to me. | Something about a month ago sparked the spike in price, would have to investigate if insider dumps are happening right now.

David —-> Stu: There has to be insider info on some of those moves.